Using points and miles for free travel – a beginner’s guide

Whether you are completely new to points and miles or are a seasoned enthusiast, I welcome you to this introductory page. Everyone reading this post is able to do what I do. I promise. Yes, it has taken me over 15 years to master the tricks that I implement everyday in order to travel everywhere using credit cards points and frequent flyer miles. You can go all over the world, and visit bucket list destinations using points and miles one day, but it does take extra effort to make it happen. I hope you can take advantage of some of these tips I have implemented over the years. SO many people ask me how to book their airline tickets using their credit card points.

Travel credit cards are not all the same

First, you need to sign up for a travel points credit card. Not just ANY credit card, not your bank’s DEBIT card, or the cashback credit cards. It’s the travel rewards credit cards that will make these travel dreams with points come true.

If a credit card offers to give you “ travel points for every dollar you spend “. Those points are accumulated and credited to a “master points account”. This account should allow you to use those points by transferring them directly to a specific airline and hotel loyalty account.

The best value, in my opinion, is when you are able to redeem those points directly with the airline program and maximize an expensive plane ticket for a discounted points redemption.

Travel points credit cards vs. cash back credit cards

If traveling for “free” using travel points is your goal, then having a flexible travel points credit card is a better option than obtaining a cashback credit card. A cashback type of credit card will give you, at most, 3% cashback on your purchases, many are subject to a maximum per quarter, and at the end, that will barely afford you a round trip international ticket at the end of the year.

It would be better to earn 60,000 points one year that can be used for a round trip airfare from USA to Europe, for example, Instead of getting $600 cash back after earning the same amount of points and the airfare equivalent costs thousands of dollars.

Avoid getting specific airline and hotel credit cards

When starting out, avoid getting specific airline or hotel branded credit cards until later on. These branded credit cards will limit how you earn your points to only those brands and their redemption programs.

Hotel credit cards can sometimes offer a “free award night certificate” for all credit card holders, on an annual basis. This can be nice if you can also add to those programs from your main travel credit card. These are good secondary cards you can have and be able to add to them when needing to redeem an award night with a hotel, or obtain extra perks with the airline, if flying them specifically.

Focus on obtaining a main travel points credit card that earns points which can then be transferred to several airline frequent flyer programs or a few different hotel brands. This is better than just having one airline or hotel option to redeem points through.

For example, all major US airlines have their own branded credit cards, like, Delta, American Airlines and United Airlines. These points will only work when being redeemed inside those airline frequent flyer programs.

As secondary credit cards, the airline and hotel brands may have lucrative welcome offers that may help you top off an account or add to a program you need a large amount of points for.

What cards you decide to get, will vary greatly on factors like:

- the amount of tickets you are looking for,

- what class of seating and

- how far do you want to go.

- do you wnat to make stops along the way?

This will help decide if you might need to apply for other branded cards to meet your redemption goals.

Why earn travel points with credit cards?

Because earning the credit card “points” earned from everyday spending, which can be converted into super expensive travel, is 5-10 times more valuable than simply obtaining cashback or simply using a travel portal offered by other credit card companies. Using debit cards is not recommended because you will not earn any travel points and you lose a lot of protection and other benefits. Recommended beginners cards are chase Sapphire Preferred at a low annual fee and plenty of travel partners to move points to.

Get the most value from A FLIGHT award redemption

FLIGHT Award search TOOLS

When redeeming credit card points for airline tickets, it is important to search for the points cost first. To determine the best value will require some trial and error, along with different route combinations and airline partners. It’s important to know the cost in points of your desired travel plans as early as possible in the planning process.

Resources to help find flight ROUTEs:

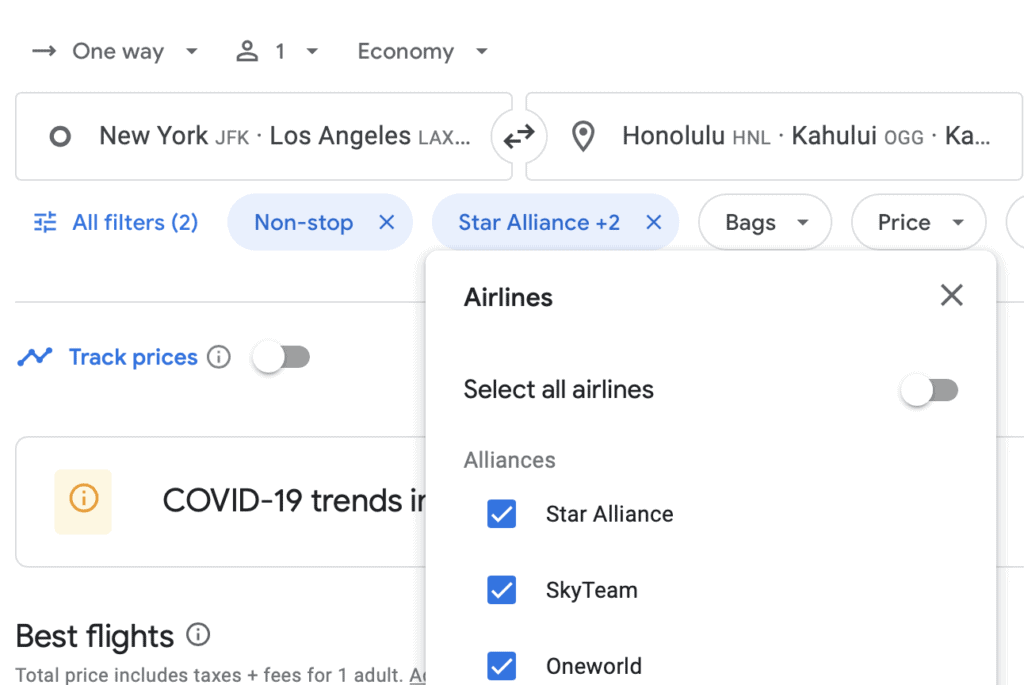

1- Google Flights

1- Search Google Flights for cash prices and routes options and airlines

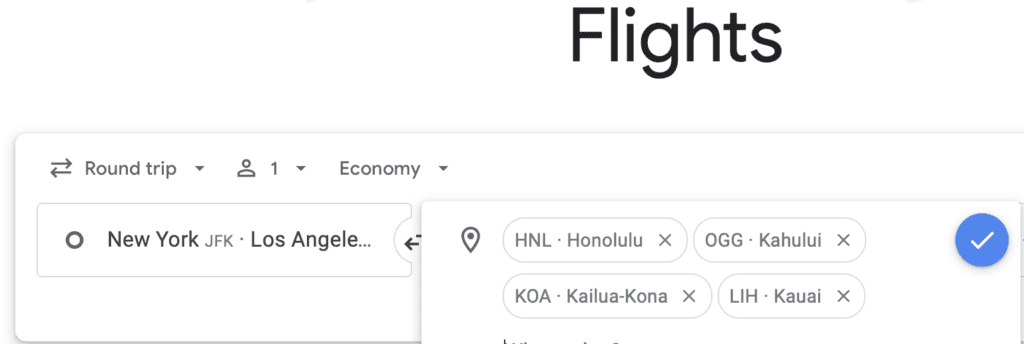

Use different departure cities, especially main hubs like JFK, MIA, IAH, IAD, LAX, ORDSort by airline and focus on airline alliances you can later transfer points to and select alliances

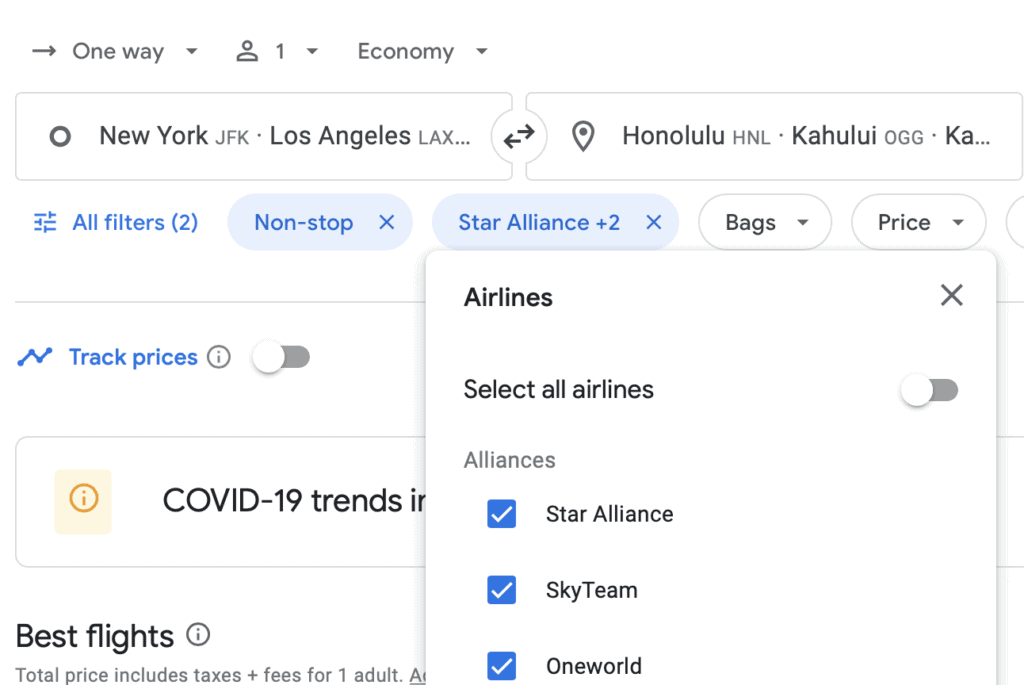

- One World

- Star Alliance

- Skyteam

Search to several destinations and airport codes at the same time.

Sort further and eliminate unwanted airlines and add multiple cities nearby to search non stop routes.

Limit the search to exclude Spirit, Southwest and Frontier airlines.

This ensures that your search results will be airlines that are part of an Alliance that you will be able to redeem using credit card points. Most flexible travel points cards should allow you to transfer points from your credit card account to the frequent flyer program.

2- FLIGHTCONNECTIONS.com

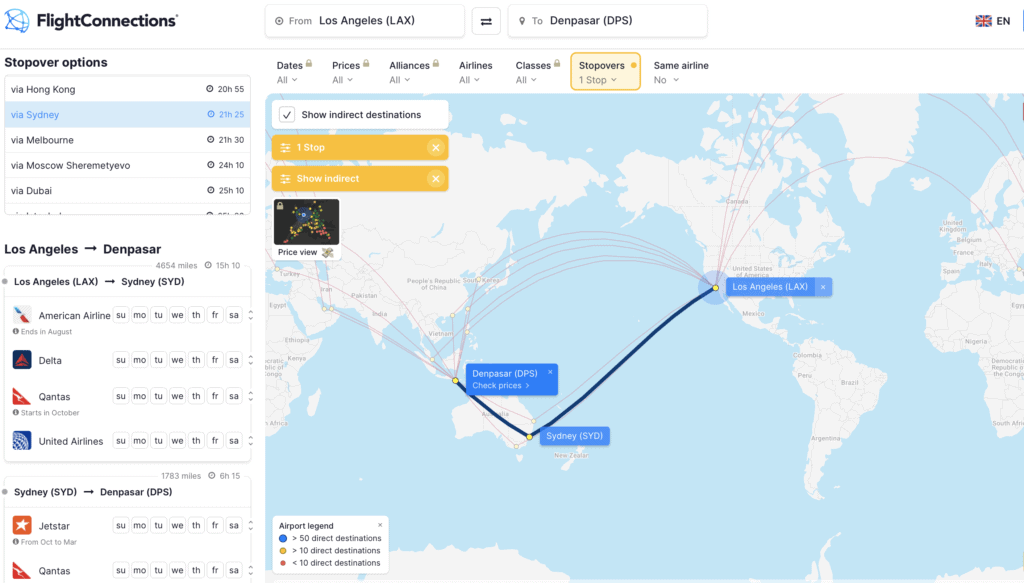

Use Flightconnections.com to view routes combinations and airline partners

View different route options and stopover cities.

Focus on destination and see what airlines fly there non stop.

Determine which airlines you are able to transfer and redeem points through and search directly within their award search systems. This helps determine what alliances you can send points to, once you know of which airlines are connected to each other via an Alliance.

3- MILEZ.BIZ

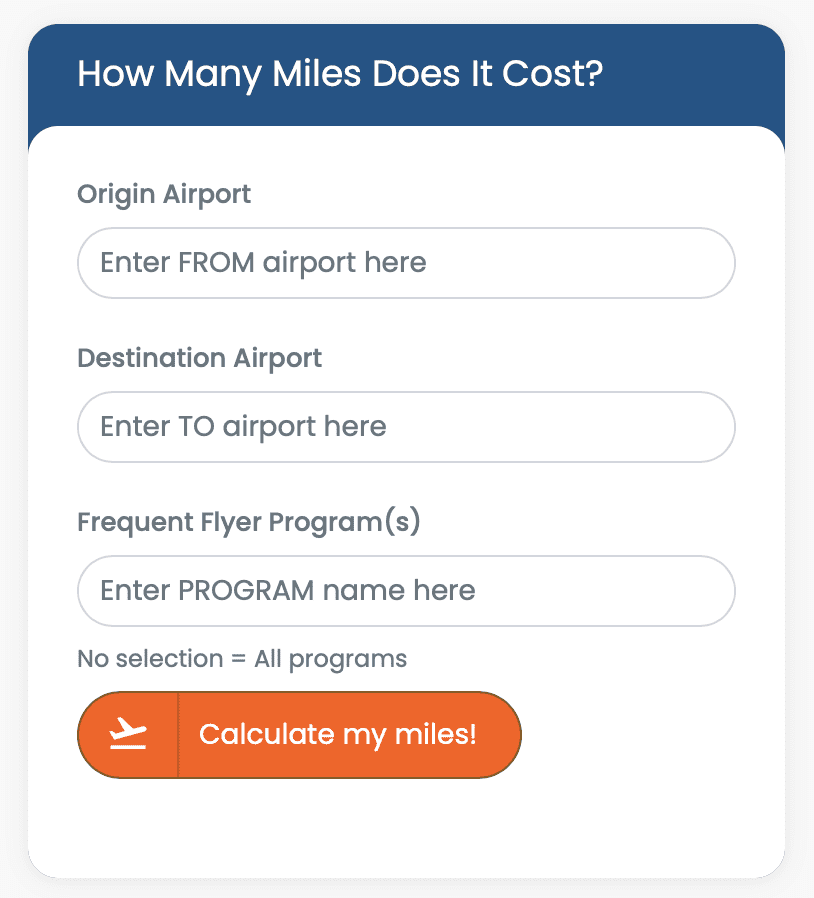

- www.Milez.biz to view points prices and airlines (limited search)

Limited searches available per month and can be upgraded to Pro version.

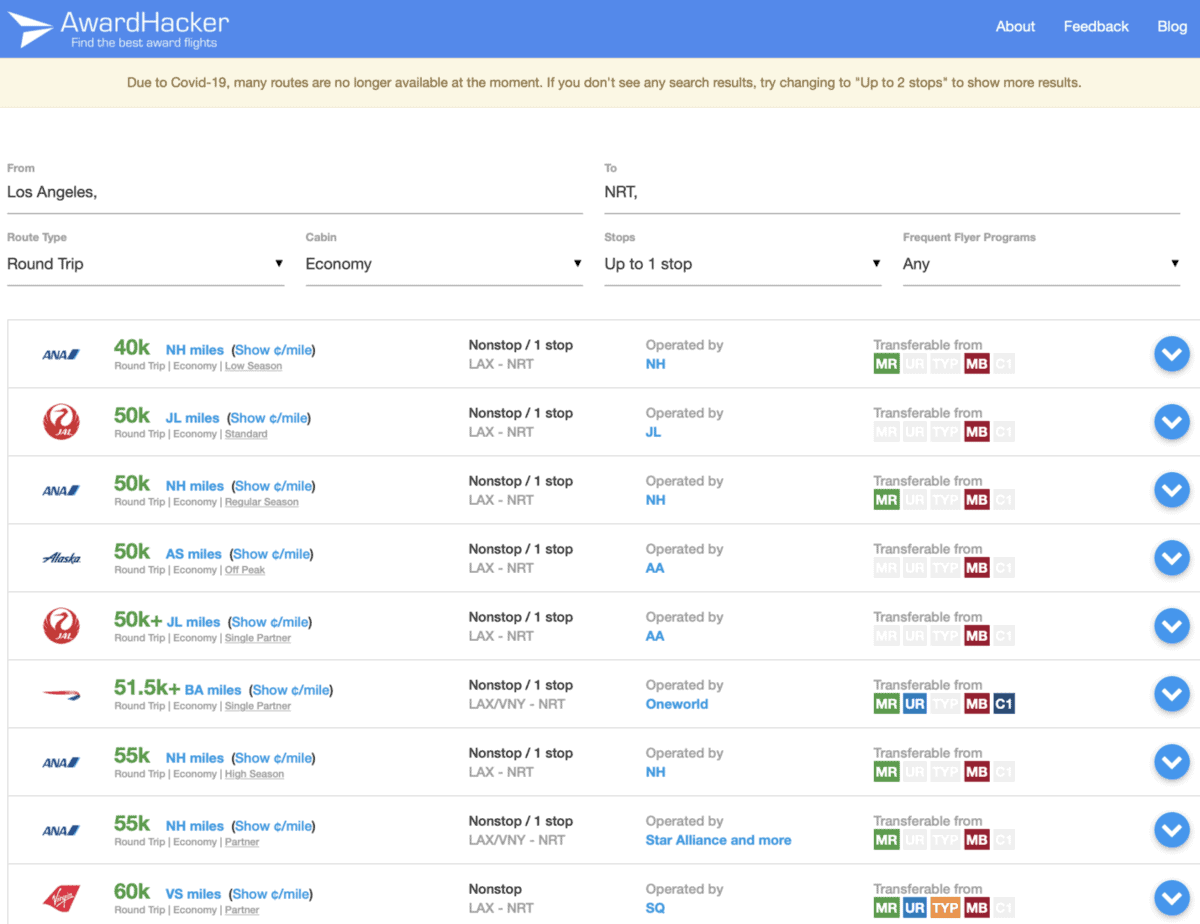

4- AWARDHACKER.com

Use www.Awardhacker.com to view approximate points prices and narrow down by frequent flyer programs and points currency.

It will provide an an approximate cost in points of your route, regardless of your dates. For specific availability, you will need to visit the frequent flyer programs.

5- POINT.ME

Since point.me launched, I decided to try the day pass and found the ability to search within 33 different programs all at once, for any given day, was great. YOu can search for desired cabin and number of award seats needed.

It also pointed out airline redemptions I did not think of searching with that I could transfer specific credit card points programs to book those flights. This tool saves a lot of time but you have to search each day at a time.

SET TRAVEL GOALS AND FIND POINTS COSTS

Knowing where to go and how much it will cost is half of the work. Using tools to help price out a potential trip will take time, but you will be able to get a rough idea by using some of the tools and running your numbers in the end to determine what makes sense for you and your travel plans.

Search for specific award availability with the airline or desired airline partner’s frequent flyer system. This will show you what is available to be bokked, how many seats and any applicable taxes and surcharges.

Maximize ALL credit card spending categories

Learn which credit cards will provide extra bonus points based on spending categories (expenses like gas/ groceries/ travel).

Before paying for any expense by using my credit card, I need to know which credit card will earn MORE than 1 point per dollar on regular expenses that I plan on spending money on already. Some cards will pay 2 or 3 points when using the points credit cards for specific expenses such as dining, cable/internet, gas and groceries. It is important to know which cards are used for what and how much they earn for those categories.

Use Cardpointers app to load all the type of credit cards you have, without entering your actual credit card information) and under “pointers” you can view all the spending categories and which of your credit cards will earn you x amount of points for that category.

It is very convenient when on the go and you need to figure out which credit card to use, and have several choices

Decide WHAT CREDIT CARDS to accumulate points IN

A flexible travel points credit card to should start with one that allows your to have choices when you are searching for award travel.

A beginner’s card is the Chase Sapphire Preferred, allowing you to earn Ultimate Rewards points and they can be transferred to 10 Airline Frequent Flyer programs and 3 hotel brands.

Another great option I suggest is American Express Gold where you can earn Membership Rewards points and be able to transfer to 17 airlines and 3 hotel brands.

Capital One Venture X has 14 airlines and 3 hotel partners.

Chase and American Express, Citi, Capital One all earn flexible travel points that can be transferred to many different programs, which will give you endless options for free airline tickets booked using credit card points and miles.

You can sign up for the card that is right for you and the airline partners it provides. This will help you accumulate the points you will need for your desired trip or points vacations.

Final Thoughts

The best use of credit card points is for airline tickets that are a high value but low cost in points. Those are the sweet spots I am looking for. Knowing the price of the vacation in points, including airfare and hotel nights, will help you determine how many points you need to accumulate for your desired trip.

Starting with a goal in mind and knowing the number of points you will need to accrue for the award redemption you are looking for, will help set a strategy as to how many points you will need to accumulate, how to maximize earning those points and maybe decide to sign up for welcome bonuses, as they are necessary.

Over time, you can use these basics to build on and apply to different cards that will suit your travel and spending lifestyle. This will serve as a beginners guide and build up to how to search for award travel with different airlines.

For existing guides on Points and Miles for beginners, feel free to download my freebie guide with lots of useful links from previously held workshops.

Where would you like to go using points and miles? Please leave a comment with your nearest airport hub, destination dream and where you have points currently? Ultimate Rewards, Membership Rewards, Citi or other?