American Express Platinum Business VS Personal Card – Compare Credits and Benefits

AMERICAN EXPRESS PLATINUM BUSINESS VS PERSONAL CARD

Premium cards come with a high fee and also with plenty of perks and credits that are great if you can maximize them. I like to earn my money back to offset annual fees by using the monthly and annual statement credits. This is my personal review after getting both of these cards, with Player 2 mode, in time for the holidays and year end business expenses.

There are different credits and offers available for the two cards. Some of the credits will require that you register first and American Express will credit your account statement later, as it recognizes the charges. Most importantly, you only receive a Welcome Offer once in a lifetime, per product, with American Express, so I think these are two great cards to consider.

Comparison of AMEX Business vs. Amex Platinum personal

You can earn 120,000 Membership Rewards® points after you spend $15,000 on eligible purchases with your Card within the first 3 months of Card Membership. If you prefer applying for the American Express Platinum personal card, you can earn 100,000 Membership Rewards points after spending $6,000 within 6 months of card membership.

BENEFITS of American Express Business Platinum Card

Earn 5X Membership Rewards® points on flights and prepaid hotels on amextravel.com.

Earn 1.5X Membership Rewards® points on eligible purchases in key business categories, as well as on purchases of $5,000 or more everywhere else. Cap applies.

You can earn over $1,000 in value per year for statement credits on select purchases with your card, including up to:

- $400 with Dell Technologies

- $360 with Indeed

- $150 with Adobe Cloud

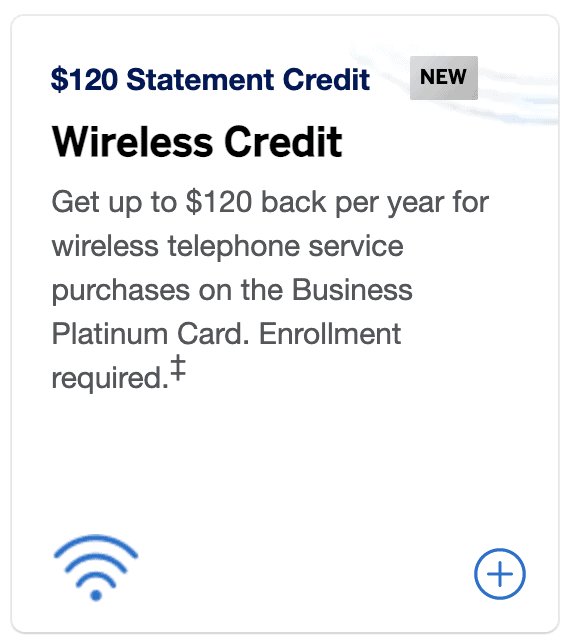

- $120 on wireless telephone purchases. Enrollment required.

- $200 Airline Fee Credit: Get up to $200 in statement credits per calendar year toward baggage fees and more at one qualifying airline.

- $179 CLEAR® Credit: Use your Card and get up to $179 back per year on your CLEAR® membership.

- Priority Pass Membership – Access to more than 1,300 airport lounges across 140 countries and counting with The American Express Global Lounge Collection®.

- $595 Annual Fee ($695 if application is received on or after 01/13/2022).

Personal American Express Platinum Card Benefits

The personal American Express Platinum card provides monthly credits that can be utilized for everyday expenses, like:

- WALMART + Monthly membership Credit ($12.95 monthly) – great for same day delivery of groceries and many other household items (value $155). Read more.

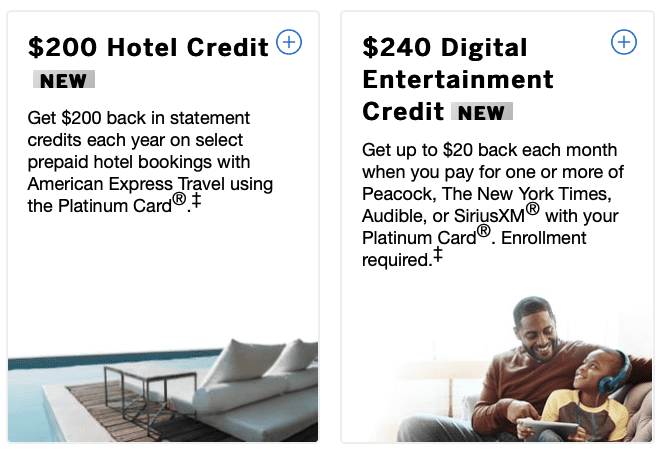

- $20 monthly Digital Entertainment credit – Try Audible, SiriusXM, Peacock, New York Times ($240 annual digital credit). Enroll here.

- $15 monthly UberEats/Uber cash + plus $20 bonus in December (up to $200). Enroll here.

- $300 Equinox Credit & SoulCycle At-Home Bike Credit. Enroll here.

- $179 CLEAR credit (up to $179). Find out more and enroll here.

- Fee Credit for Global Entry or TSA Pre

- $50 Saks.com semiannual credit ($100 value). Enroll here.

- $200 Airline fee credit- Need to preselect an airline before incurring the charges. You can change as needed but may require a call with an agent.

- Priority Pass Membership – Enroll online and obtain digital Priority Pass for immediate use

- The Centurion Lounge Club Access for yourself and another guest. Centurion Lounge details..

- Fine Resorts + Hotels $200 Hotel Credit – when using AMEX Travel to book 2 nights at their Fine Hotels & Resorts and includes upgrades and daily breakfast for two

- Hotel Collection Credit – A $100 experience credit to spend on qualifying dining, spa, and resort activities. Must be for 2 nights or more on a prepaid stay.

- Hotel Status upgrade: Marriott Bonvoy Gold Elite Status – Enrollment Required

- Hotel Status upgrade: Hilton Honors Gold Status – Enrollment Required

Related: Benefits of Amex Platinum

Benefits offered by the Business Platinum only

- $400 with Dell Technologies

- $360 with Indeed

- $150 with Adobe Cloud

- $120 on wireless telephone purchases. Enrollment required.

- $200 Airline Fee Credit: Get up to $200 in statement credits per calendar year toward baggage fees and more at one qualifying airline.

- $179 CLEAR® Credit: Use your Card and get up to $179 back per year on your CLEAR® membership.

- Priority Pass Membership – Access to more than 1,300 airport lounges across 140 countries and counting with The American Express Global Lounge Collection®.

- $695 Annual Fee

35% Airline Bonus when redeeming points with Membership Rewards

$350 Indeed annual statement credit

$120 ($10 monthly) statement credit for wireless telephone service

$150 Adobe Creative Cloud Annual Statement Credit

$400 Dell Technologies Annual Statement Credit

Airport Lounge Access

Both American Express platinum cards offer Centurion Club lounge access and Priority Pass Membership. This allows each of us to bring 2-3 guests, depending on the Priority pass lounge rules, inside the lounge when traveling. This works for us when traveling with other friends or family, especially our kids. Make sure to register first. (ADD LINK)

Priority Pass Registration once you receive an invitation code. With Priority Pass you can access more than 1300 airport VIP lounges worldwide.

Are the American Express Platinum cards worth the annual fee?

American Express Platinum has an annual cost of $695 and the Business Platinum is $595.

This is a steep fee for many people, especially if you do not plan on traveling much and using some of the benefits mentioned. There are different credits and offers available to the two cards and if you can maximize the monthly and annual credits, you can have this card pay for itself.

Tip: Use the mobile wallet to add your credit card information under for all family members

save the authorized user fee

One of the main reasons I have both the personal and business cards, is that I can use each one as a primary card holder and obtain a Priority Pass membership under myself and also under my spouse, aka Player 2. I can stack the offers from one card that the other card does not offer.

It would make sense to use all the credits to make up for the annual fees and decide if keeping the card is right for you.

What if I do not need the credits and benefits?

If you can give the gift to someone to get a free audible book of choice, or Walmart +, or go shop for gifts at Saks.com. It makes sense to use them, whenever possible, or consider gifting unused credits to someone you know. You can give the gift of the free checked luggage with your chosen airline for up to $200 for someone else who is traveling.

My thoughts on the American Express Business Platinum?

I decided to go for this card in light of the holiday season that is upon us. It would be easy to get the credits from Dell and use them as Christmas gifts, for example. If using them for yourself, just wait for the reset of the $200 credit in January. Using the airline fee credits is convenient for end of the year travel and the ability to use the lounges for the family is a plus.

The Welcome Offer for the Business Platinum is very high, at 120,000 American Express Membership Rewards. It also comes with several monthly and annual credits that we can use for our upcoming expenses in the holiday season. Both offers are great if you want to accumulate some very valuable Membership Rewards points and use up some credits for end of the year expenses or help meet the minimum spending requirements..

When using credits for either the personal or business AMEX, remember to stack these purchases with Rakuten and other shopping portals in order to maximize earning points.

Should I consider applying for American Express personal vs Business Platinum?

This card is best for those that have excellent credit (650-850) and are able to pay for the balances in full at the end of each month.

Accumulating Membership Rewards points is great for points diversifications purposes. If you currently have other travel points credit cards that transfer to loyalty programs, you know the value of transfer partners.

Having Membership Rewards points allows you to transfer them to 17 different airline loyalty programs, giving you access to so many travel options around the world.

Membership Rewards, as very valuable because you can transfer points to all the major travel alliances, providing you with endless award booking possibilities. This includes going around the world in Business Class with ANA airlines, Hawaii with Singapore Airlines, or short hauls with British Airways, Iberia, and Aer Lingus, just to name a few of the possibilities. More on those award routing rules later…

Would you consider the personal, the business, of both platinum cards?